Table of contents

Table of contents

What is a BCG matrix?

Summary

In this guide, you will learn:

What the BCG Matrix is: a strategic framework that categorizes products based on market share and market growth rate to guide investment and resource allocation decisions

The four quadrants of the BCG Matrix: Stars (high share, high growth), Cash Cows (high share, low growth), Question Marks (low share, high growth), and Dogs (low share, low growth)

How the matrix uses two axes—market share (horizontal) and market growth rate (vertical)—to evaluate product portfolio performance and potential

The strategic implications of each quadrant, such as investing in Stars, milking Cash Cows, evaluating Question Marks, and divesting Dogs

The origins and enduring relevance of the BCG Matrix as a tool developed by the Boston Consulting Group in the 1970s for portfolio management

The benefits of using the BCG Matrix, including clear visualization of product status, prioritization of investments, and optimization of profitability through resource allocation decisions

Enhance your business strategy with the BCG matrix

The Boston Consulting Group (BCG) matrix is a powerful strategic management tool. It is known for its efficacy in product portfolio management.Also called the BCG growth-share matrix, the framework aids businesses in understanding their products' positions in market growth and share. This enables them to make informed decisions about resource allocation, marketing, and strategic development.

Understanding the BCG growth-share matrix

Bruce Henderson, the founder of the Boston Consulting Group, created the BCG matrix in the 1960s.Henderson revolutionized strategic planning with a visually intuitive representation of a company's product portfolio. This process effectively illuminates growth and resource allocation avenues.Since its creation, the BCG matrix has maintained its stature as a powerful tool for strategic planning, extensively employed by businesses globally.

The structural design of the BCG matrix

The BCG matrix classifies products based on their growth rate and relative market share, guiding businesses in formulating resource allocation and growth strategy.Apart from the BCG matrix, other growth-share matrix models, such as the GE-McKinsey matrix, are also used. This alternative framework evaluates market attractiveness and business strength, offering a slightly nuanced perspective for product portfolio analysis.While distinctive in features and applications, each framework shares the common objective of providing valuable insights to inform strategic decision-making.

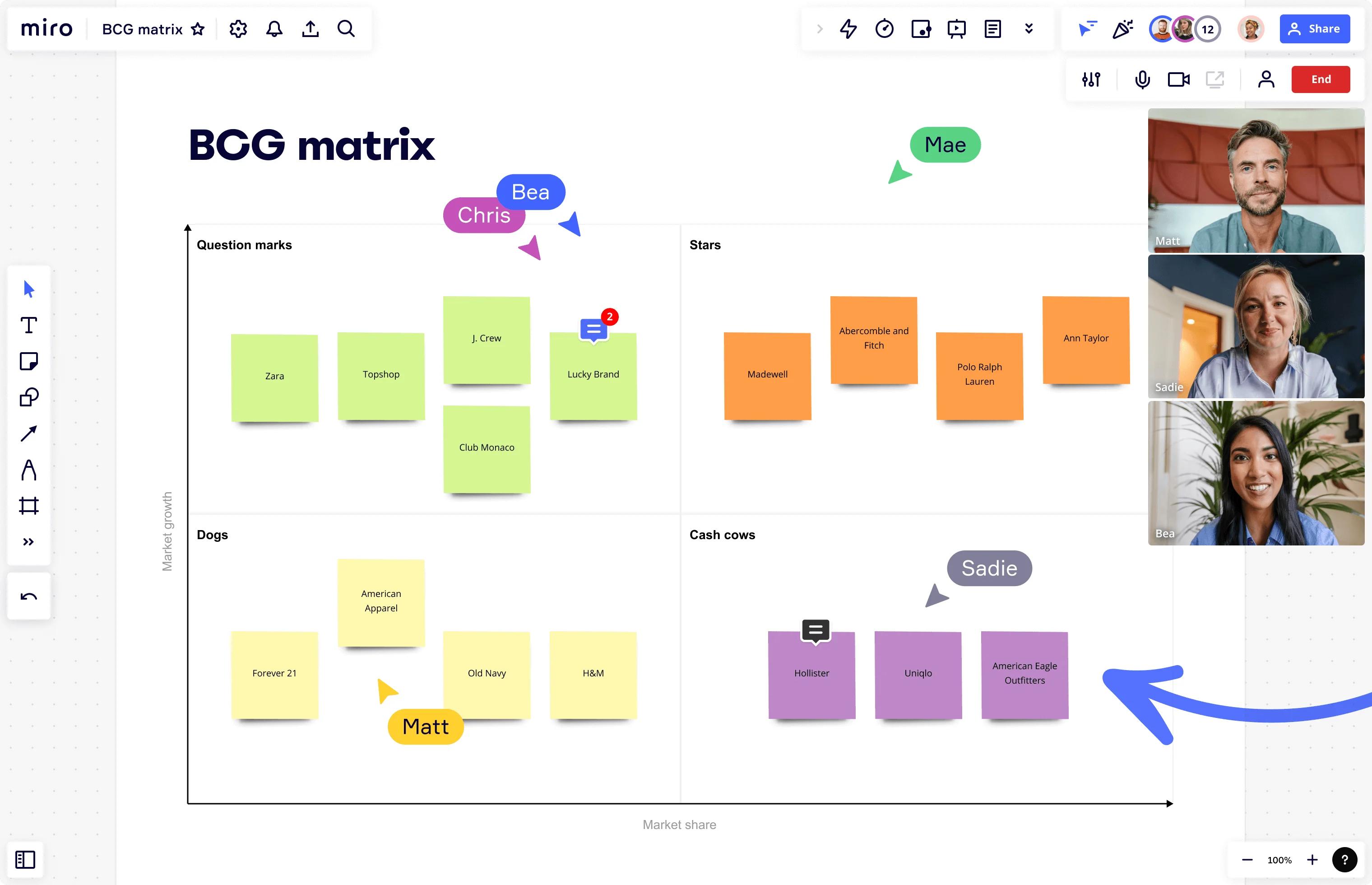

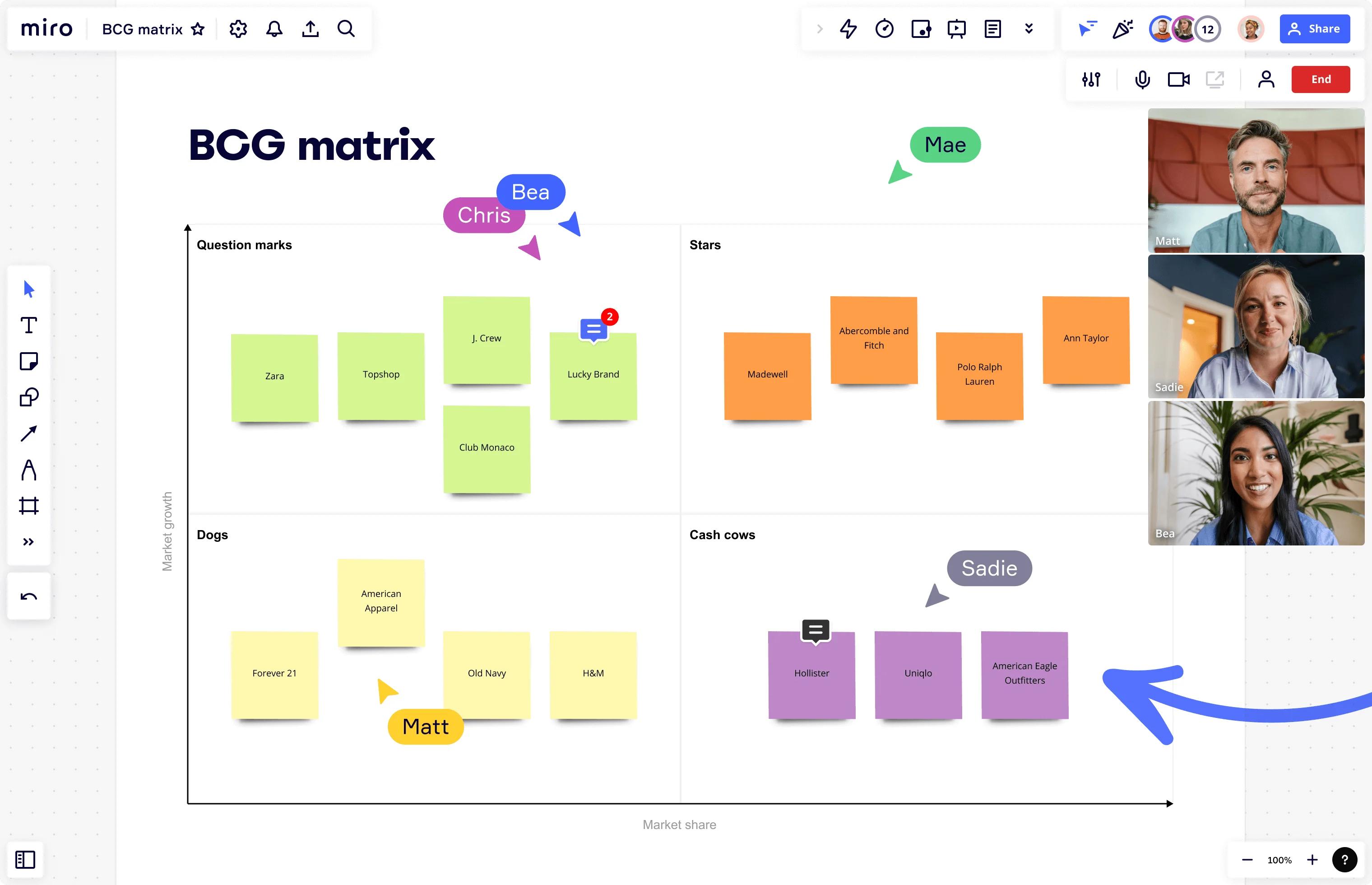

What is the BCG matrix?

The BCG matrix is designed to help you evaluate your product portfolio. This allows you to make data-informed decisions about resource allocation, product roadmap development, and overall growth strategy.Consider the BCG matrix as your business compass. Similar to how a compass steers you onto the correct path when you're disoriented, knowing how to apply the BCG matrix helps businesses make strategic decisions about their products and services.It categorizes your offerings into a two-dimensional matrix based on two crucial parameters:

Relative market share

This dimension signifies a product's market share relative to its competitors within the same market segment. A superior relative market share suggests that the product is a market leader and may yield higher revenues.[Market Share (%) = (Your Total Sales / Total Industry Sales) * 100]

Market growth rate

This dimension gauges the growth potential of a specific market or industry, usually expressed as a percentage. A higher market growth rate implies a greater potential for expansion and increased product sales within that market.[Market Growth Rate = (Total Sales This Year / Total Sales Last Year)]Employing the BCG matrix helps you pinpoint which products are critical for success and which might be burdensome.By harnessing the insights offered by the BCG matrix, you can prioritize investments more efficiently, discover new growth opportunities, and make evidence-based decisions that drive your business toward sustained success.

How to apply the BCG matrix: Master the four quadrants

The BCG matrix features four quadrants, each representing a different product or business unit:

Stars

These products, boasting high market share and growth, act as your business's rising champions. Stars require investment to maintain their market position and fuel their growth. Monopolies and first-to-market products often fall into this category.Tip: Allocate resources to stars to ensure a successful growth strategy.

Cash cows

These products have a high market share but low growth. Cash cows produce steady profits with minimal investment. Use the profits they generate to stimulate growth in other areas.Tip: Use these business units or products as market leaders to generate the cash needed to support other initiatives within your company.

Dogs

These underperforming products show both low market share and low growth. They don't contribute substantial profit or consume significant cash, and they can tie up resources you could use better elsewhere.Tip: Consider dogs as prime candidates for divestment or elimination.

Question marks

These unpredictable elements in your portfolio show low market share and high growth. They consume cash without providing significant returns. However, their rapid growth indicates they could evolve into stars.Tip: Invest in question marks with promising growth potential, or divest if they're likely to devolve into dogs.Understanding each quadrant helps you make informed strategic resource allocation and investment decisions.Use the BCG matrix's insights to prioritize investments effectively, uncover new growth opportunities, and make data-driven decisions that propel your business toward long-term success.Understanding each quadrant helps you make strategic decisions about resource allocation and investments.

Creating a BCG matrix: A step-by-step guide

Navigating the business landscape can be complex. Fortunately, strategic tools like the BCG matrix can help streamline this process, offering clear insights into your product portfolio's performance.Here's a detailed, step-by-step guide to help you construct your own using the BCG matrix template:

List your products or business units

Your first step involves identifying all the products or strategic business units you wish to assess.Keep this list focused and manageable. This step will form the basis of your analysis, so carefully consider which products or business units are most relevant to your strategic planning.

Determine market share and growth rates

Next, gather relevant data for each product or business unit.You'll need information about both market share and growth rates. The accuracy of your data is critical. Incorrect or outdated data could skew your results. Use reliable sources and ensure your data is current.

Plot products on the matrix

With your data in hand, it's time to plot your products or business units on the matrix.Place each one in the appropriate quadrant (star, cash cow, dog, or question mark) based on its market share and growth rate. This visual representation helps in understanding your product portfolio's status and potential.

Evaluate and prioritize

Now, analyze the positions of your products within the matrix.Look for your:

Stars (high growth, high market share)

Cash cows (low growth, high market share)

Dogs (low growth, low market share)

Question marks (high growth, low market share)

This step will help you see where to allocate more resources, invest further, or consider divestment.

Make strategic decisions

Finally, use the insights you've gained from your BCG matrix to guide your strategic decision-making.Doing this could involve adjusting your resource allocation, reshaping your investment strategy, or even reconsidering your product development pipeline. Remember, the BCG matrix isn't a standalone tool but a part of a broader strategic toolkit.Creating a BCG matrix can provide valuable insights into your product portfolio, helping you make data-driven decisions that can help illuminate the path to growth and profitability.Remember to revisit your BCG matrix periodically as market conditions change, ensuring your strategies align with your business's evolving context.

BCG matrix unveiled: Advantages and disadvantages

The BCG matrix is a formidable strategic planning tool, but you must recognize its benefits and limitations. Understanding these elements allows you to capitalize on its strengths and counterbalance its weaknesses, maximizing its value to your business.

Five advantages of the BCG matrix:

Before applying the BCG matrix to your strategic planning, understanding its advantages can help you make the most of this tool. Here are the five key benefits of the BCG matrix:

Clarity: The matrix distills complex business decisions, empowering you to prioritize resources, enhance product strategies, and stimulate growth effortlessly.

Strategic direction: The BCG matrix offers clear guidance on investment opportunities, product evaluation, and efficient resource allocation.

Data-driven decisions: The BCG matrix fosters informed, data-driven decision-making that boosts overall business performance by dividing products into four distinct quadrants.

Portfolio snapshot: The matrix provides a visual overview of your product portfolio, helping you quickly identify strengths, weaknesses, and potential growth areas.

Resource maximization: The matrix guides resource allocation, directing investments towards products promising the highest returns.

Five disadvantages of the BCG matrix:

While the BCG matrix has numerous advantages, it's important to consider its limitations. Knowing these potential pitfalls can help you use the matrix more effectively and ensure a more nuanced and comprehensive analysis. Here are the five main disadvantages of the BCG matrix:

Limited scope: The matrix might overlook external factors, product synergies, or unique business aspects, leading to incomplete analysis.

Static picture: The matrix captures a singular moment, potentially missing the dynamic nature of markets and competitive landscapes.

Market share constraints: Sole reliance on market share as a competitiveness indicator could miss niche products or disruptive innovations with significant potential.

Growth-centric: The BCG matrix's focus on market growth rates can sometimes lead to overemphasizing growth markets while potentially underestimating other crucial performance metrics.

Rigid quadrants: The strict quadrant structure might not fully encapsulate product performance nuances, as some products may fall between categories or exhibit characteristics of multiple quadrants.

By acknowledging and addressing the BCG matrix's limitations, you can unlock its full potential and optimize its value in your strategic planning.

Tips for maximizing the BCG matrix's potential

Having seen the BCG matrix in action, let's delve into some tips for optimizing this strategic tool's usage.

Stay objective

Maintain objectivity when evaluating your products. Avoid personal biases or emotional attachments. Rely on accurate data and unbiased analysis to inform your decisions.

Monitor your portfolio

Using the BCG matrix isn't a one-time exercise. Reviewing your product portfolio ensures you stay on top of market changes, enabling you to adapt your strategy as needed.

Keep an eye on the competition

A watchful eye on future competitors and market trends will help ensure your BCG matrix remains a dynamic strategic tool.

Don't solely rely on the BCG matrix

The BCG matrix is a powerful tool, but it's most effective with other strategic frameworks and a deep understanding of your business. Remember, no single tool guarantees success, but the BCG matrix helps cover many strategic bases.

Author: Miro Team Last update: August 12, 2025