What is a risk matrix (and how to use one)

Summary

In this guide, you will learn:

What a risk matrix is and how it visually represents risks by combining their likelihood and impact

The common formats of risk matrices, including the widely used 5x5 grid structure

How to identify and evaluate risks to input them effectively into a risk matrix

The role of color-coding in categorizing risk severity for easier prioritization

The process of monitoring and updating the risk matrix as risks evolve over time

How organizations customize risk matrices to fit their specific risk management needs and contexts

Try Miro now

Join thousands of teams using Miro to do their best work yet.

Identifying potential risks is a vital part of business success. If you’re not aware of the challenges your business might face, you won’t be prepared to deal with them. And if you’re not prepared, the damage will be harder to control.

This is where a risk matrix can be helpful.

When done well, a risk matrix identifies potential risks, the likelihood they’ll happen, and what the impact could be. As a result, you can put preventative measures in place and have strategies to mitigate the damage.

In this article, we’ll show you what a risk matrix is, why it’s important, and how to create one of your own.

What is a risk matrix?

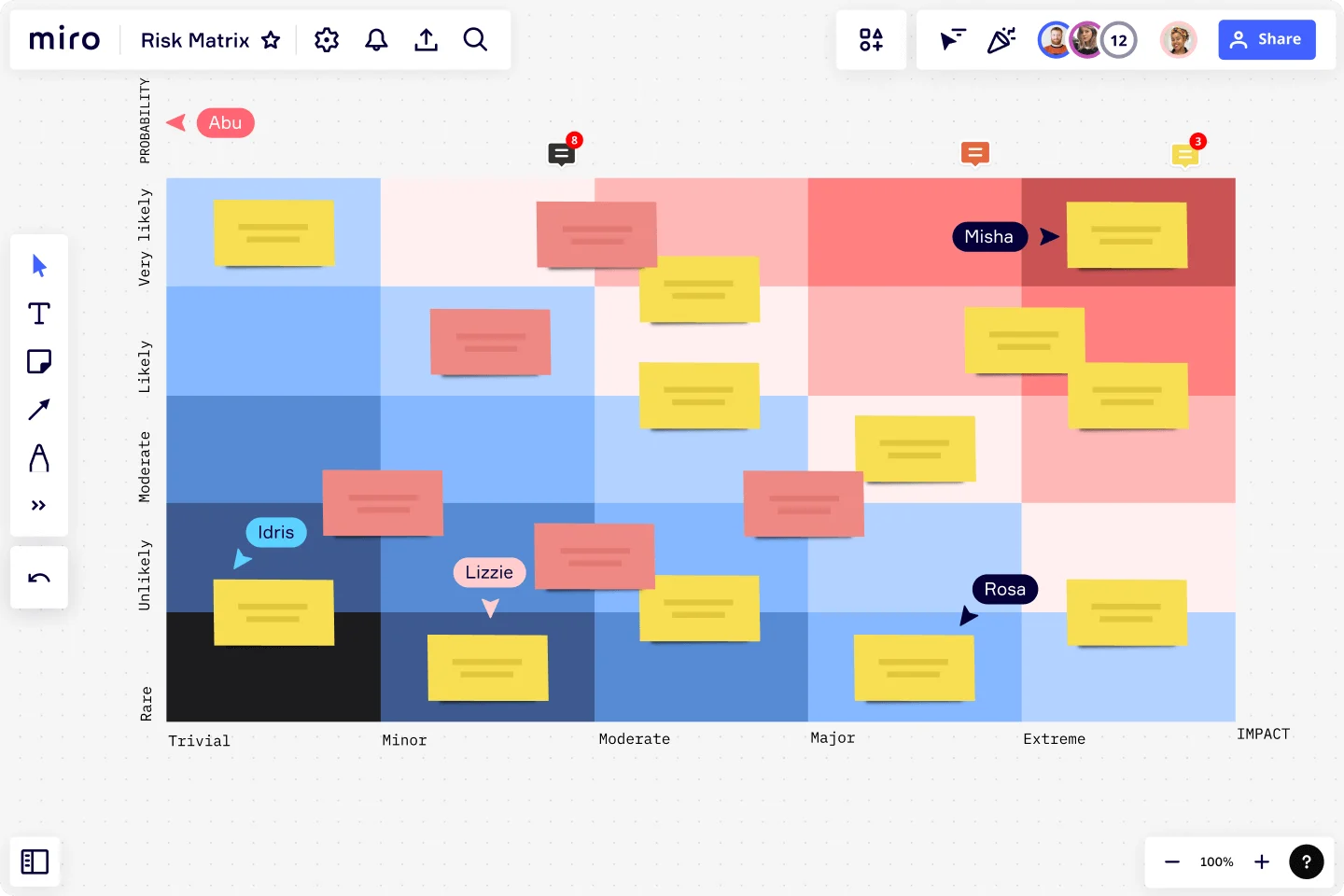

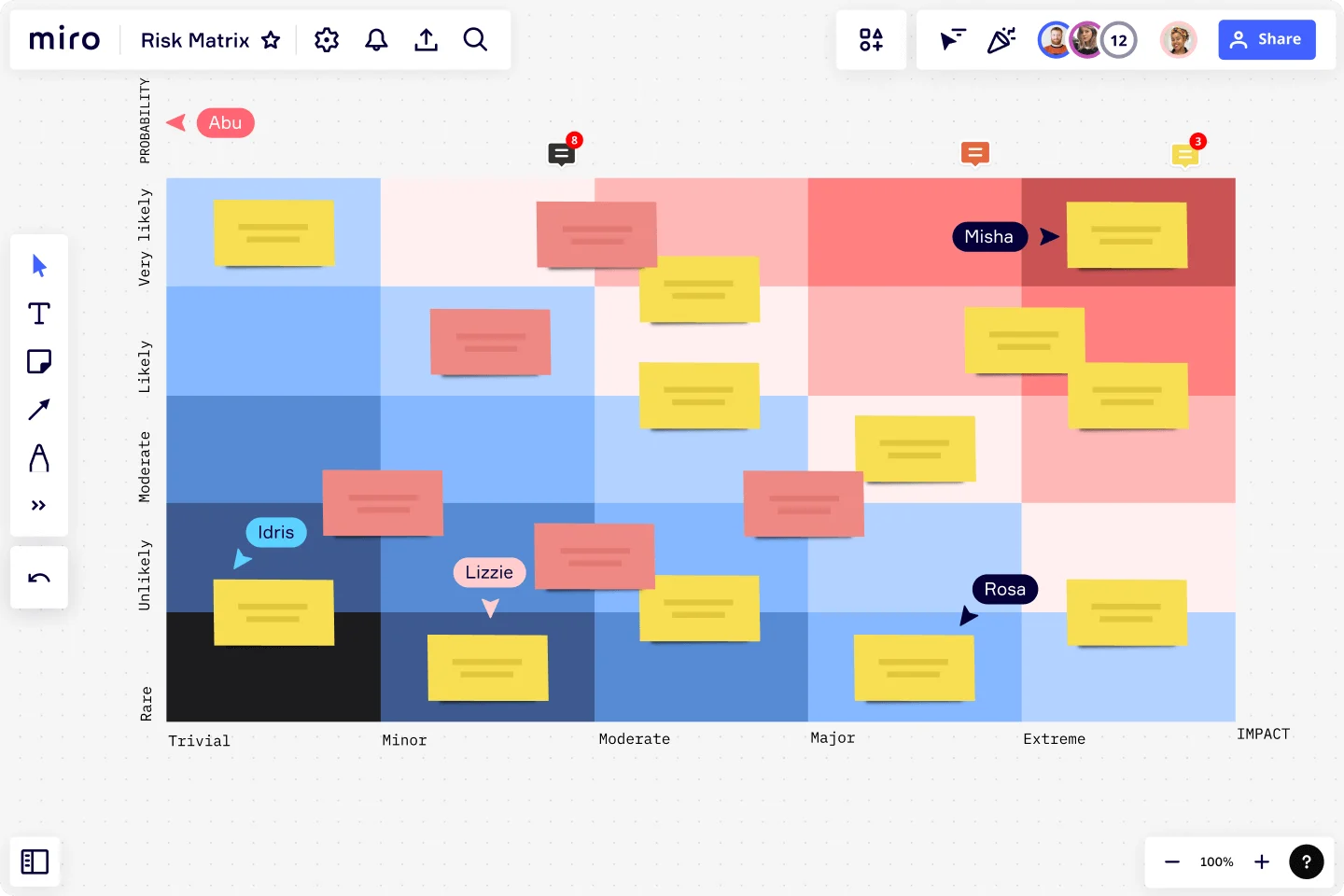

A risk matrix is a visual tool that assesses and prioritizes risk. It analyzes how likely it is that a risk will occur, as well as the potential impact it’ll have on your business.

The matrix typically consists of a grid with four quadrants. The ‘likelihood of risk’ sits on one axis, and the ‘potential impact of the risk’ sits on the other. Each cell represents a different level of risk, allowing you to easily determine which risks require the most attention and resources.

For example, you can use the matrix to identify a risk that’s highly likely and will cause a lot of damage. As a result, you can put preventative measures and contingency plans in place before tackling a risk that’s unlikely to happen.

Why use a risk matrix?

Let’s outline some of the reasons a risk matrix chart can be beneficial.

To proactively prepare for challenges

A risk matrix provides a consistent approach to risk management. It ensures that risks are identified and assessed systematically, ensuring you cover all your bases. As a result, you can proactively prepare for challenges before they arise. You know how to mitigate risk and what to do if a risk occurs, and you'll be better equipped to handle unexpected risks, too.

To assess the likelihood and impact of risks

A risk rating matrix is a visual representation of the probability and effect of each risk. This means you can clearly see whether a risk is likely to happen and what’ll happen if it does. As a result, you can prioritize your risk management efforts and allocate resources effectively.

To improve decision-making

By clearly outlining all your potential risks, you can make informed decisions about your business growth and development. For example, you can decide where to allocate resources so that you have the funds and capacity to deal with a big hit to the business.

To increase accountability

Creating a risk matrix involves assigning ownership and responsibility for each risk. This creates a sense of accountability and boosts motivation, encouraging everyone to mitigate risks to the best of their ability.

Risk management, risk control, and risk assessment: What’s the difference?

Risk management, risk control, and risk assessment often describe the same (or similar) process. But the truth is, they’re not the same.

Risk assessment and risk control are all part of the risk management process, but they have different objectives and focus areas. Here’s a brief overview of how each process works:

What is risk management?

Risk management looks to identify, assess, and control risks to achieve business objectives. It typically includes the risk likelihood and risk impact (found in the risk assessment), as well as the risk response strategies (part of the control process). The matrix is then used to monitor the risks and track the progress of risk response strategies.

What is risk assessment?

Risk assessment looks to evaluate and prioritize risks by considering their likelihood and potential impact. The risk assessment matrix typically consists of a grid with the likelihood of a risk occurring on one axis and the potential impact or consequence on the other. The likelihood and impact are usually rated on a numerical scale (such as low, medium, and high).

What is risk control

Risk control identifies and documents the internal controls needed to prevent and mitigate risks. It evaluates the effectiveness of an organization's control processes, which can help with the prevention and mitigation of risks.

How to create a risk matrix

Now that we know what a risk matrix is, let’s walk through the steps you’ll need to take to create a risk matrix of your own.

Choose a platform to create your risk matrix

To analyze risk effectively, you need a platform that allows you to create a visual and collaborative risk matrix. That way, you can work with your team to map all the potential threats clearly and concisely.

When trying to find a platform to create your risk matrix, here are some of the features to look out for:

A simple (but intuitive) interface. A platform that’s easy to use allows you to jump straight in and start creating your matrix. If it’s tricky to use, it’ll make it harder for you and your team to use it effectively.

Access to ready-made templates. A premade template saves you the time and hassle of creating a risk matrix from scratch. Take a look at Miro’s risk matrix template to see for yourself.

Ability to communicate. Creating a risk matrix often involves input from various people across the business. To make sure that everyone can work together throughout this process (especially if they work remotely), you need a platform that enables collaboration.

Identify the risks

With the platform in place, you can now identify potential risks to your business. There are a few ways to tackle this process:

Think about problems that can occur in your line of work. You’ll identify some risks simply by thinking about what your work involves. For example, if you sell clothes online, one of your risks could be a material supplier delaying a shipment.

Review historical data. Analyze historical data (such as past incidents) to find potential risks. If it’s happened in the past, chances are it could happen again.

Take a look at your competitors. Analyze what your competitors are doing and how risks have affected their business. This might help you identify risks you might not have come across otherwise.

During this process, it helps to consult with key stakeholders (both internal and external) about the type of risks that can affect your business. The more people you consult, the wider pool of potential risks you can cover.

However, this doesn’t mean you need to speak to everyone. For example, if you’re analyzing financial risks, you only need to speak to a department head or C-suite employee. You don’t need to contact the entire accounting department.

Define levels for each risk

In the matrix, you'll assign levels to each risk based on its likelihood and impact. With this information, you’ll know what types of risks are the biggest threats and can put them in the matrix accordingly.

A simple risk assessment usually has three risk levels:

Low (color-coded as green or the number 1)

Medium (color-coded as yellow or the number 2)

High (color-coded as red or the number 3).

With this scale, you can now identify which risks are a low, medium, or high threat to the business. Here are some examples of how these levels can be assigned to tasks:

If the impact means you’ll be out of business, it’s a high-risk (number 3)

If the impact means your sales will be reduced by 25%, it’s a medium-risk (number 2)

If the impact means customer shipments will be delayed by three days, it’s a low-risk (number 1)

This is just one example of the scale you can use. You can also create a wider range of levels to add more detail. Take a look at our risk assessment template as an example, which has a more complex scaling system ranging from 1–10.

Create the matrix

You know your risks, and you have your risk criteria to define the level of risk. Now, you can create the matrix.

First, you’ll add the likelihood and impact scale to the X and Y-axes. This will help you categorize your tasks when adding them to the matrix.

If the Y-axis outlines the impact of risk, you might break it down into the following risk matrix categories:

Minor

Moderate

Severe

If the X-axis outlines the likelihood of risk, here are the categories you might cover:

Unlikely to happen

More likely to happen than not

Highly likely to happen

These are just examples; you can add more or fewer categories depending on how you choose to organize your risks. For example, our risk matrix template has five categories along each axis.

With your X and Y-axes in place, you can now add risks to your matrix.

Use the categories along each axis to determine where your risks should sit. You’ll also have your levels of risk (low, medium, and high) to help you accurately categorize risks in the matrix.

Prioritize the risks

When all the potential risks are in the matrix, you can now prioritize them based on how likely they will happen and what damage they could cause. This step will help you focus on the most critical risks and allocate resources accordingly.

The great thing about a risk matrix is that it’s visual. You can look at the matrix and instantly see which risks are more likely to happen and will have the biggest impact on the business — especially if you color-code them. With one glance, you know which risks to prioritize.

If you assign scores to your risks (high = 3, medium = 2, and low =1), you can also use this score to identify the top-priority risks.

Outline your risk controls

Now that you know which risks your business has to address, you can outline your risk controls to mitigate and prevent them from happening.

Addressing the top-priority risks first, you can use risk controls to figure out the best way to prevent risks from happening. You’ll also identify how to manage risks if they occur and stop the same risk from happening again.

Here are some of the risk controls you’ll want to consider:

Preventative controls

These controls prevent a risk from occurring in the first place. For example, imagine that the risk is workplace injury to employees. In this situation, your preventative controls could be updating safety procedures, providing safety training, and using safety equipment.

Detective controls

These controls help you detect risks as they occur. Some examples include monitoring systems, internal audits, and incident reporting processes — all of which will show you when a risk is happening so you can step in and fix the problem.

Corrective controls

Corrective controls will correct a risk or prevent it from happening again. For example, repairing damaged equipment, improving processes, or revising policies and procedures.

Mitigating controls

These controls reduce the impact of a risk if it does occur. Examples of mitigating controls include preparing for natural disasters, purchasing insurance, and creating a risk response plan.

Review and update the matrix

Chances are, your risks will change over time. There’ll be new risks to contend with, risks that are no longer relevant, and you may find that some high-level risks are no longer such a threat.

Reviewing and updating your matrix regularly is important to ensure it remains relevant and accurate. This approach will help you stay on top of emerging risks and take appropriate action to mitigate them.

Author: Miro Team

Last update: October 22, 2025