How to create a monthly budget

Summary

In this guide, you will learn:

Importance of monthly budgeting for aligning income, expenses, and project goals

How budgeting promotes financial discipline, resource optimization, and early liquidity issue detection

Step-by-step instructions for Miro’s Monthly Budget Template: entering income, expenses, and tracking bills

Tips for maximizing budget efficiency: regular reviews, visual charts, tracking actual vs. projected costs, and realistic goals

How to summarize and review budget components for a clear financial overview and informed decisions

Value of ongoing budget management for project success and financial control using Miro's tools

Try Miro now

Join thousands of teams using Miro to do their best work yet.

Why do you need a monthly budget?

A monthly budget is an essential strategic plan for those in charge of a project. It outlines expected income versus projected costs and helps create a financial narrative that aligns with the project's objectives and timelines.

The benefits of a monthly budget go beyond basic bookkeeping; it promotes a disciplined approach to financial management, optimizes resource allocation, and acts as an early detection system for potential liquidity challenges. By establishing a budget, every buck is put to effective use towards the project's success, balancing current operational needs with long-term financial goals. In this article, we'll show you how to manage a budget with Miro's Monthly Budget Template.

How to make a monthly budget: A quick guide

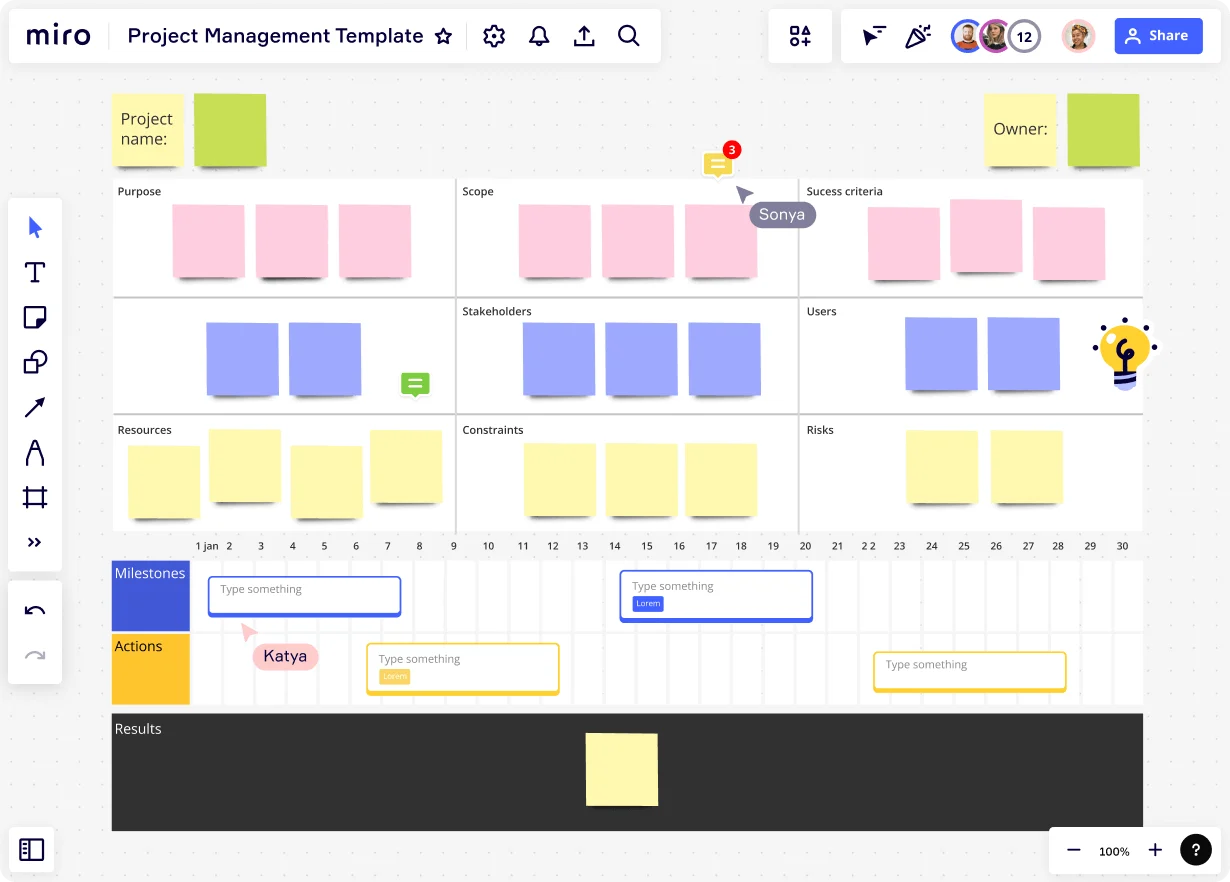

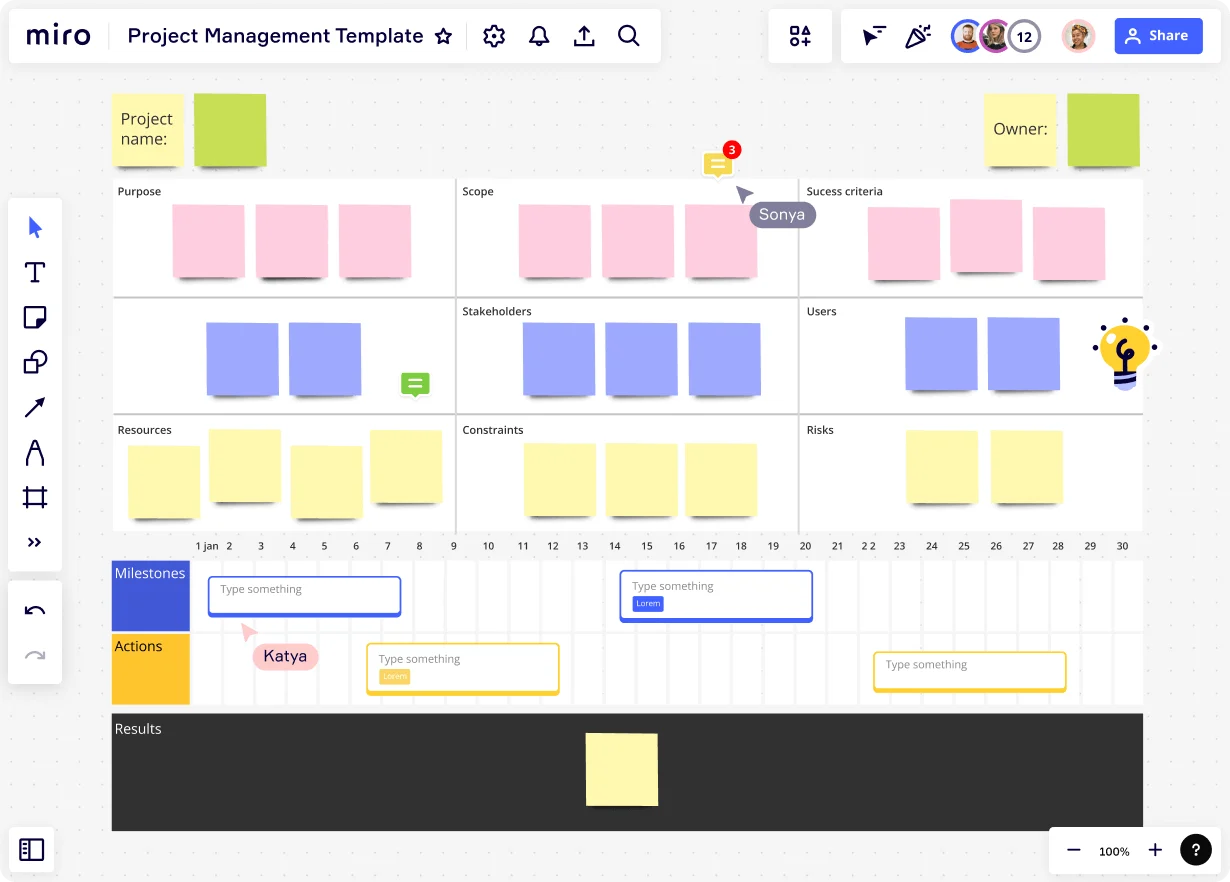

Creating a monthly budget can be a daunting task, but using the pre-designed template can significantly simplify the process. Templates offer a structured framework that professionals can customize to their needs, ensuring that all financial aspects are covered. With the foundational fields and categories already in place, it becomes easier to input and organize data, saving time and reducing the potential for errors. By starting with a clear, consistent format, you can focus on analyzing financial trends and optimizing resource allocation rather than getting bogged down in the mechanics of budget creation.

Here is a step-by-step guide on how to use the monthly budget template in Miro:

Project information

Begin by detailing your project information. Input the name of your project, a brief description, and any pertinent details that will provide context to your financial plan. This acts as a header for your budget, distinguishing it from other projects and giving stakeholders a quick reference point.

Setting goals

Next, outline your financial goals for the month. Goals might include saving a set amount of money or reducing certain types of spending. Clearly defined goals are benchmarks for your budget's performance, keeping you focused and driven.

Recording income

In the income section, document all the avenues through which money comes into your project. Whether it's a project budget, investments, or other income sources, a clear picture of your total project income is critical for accurate budget planning.

Detailing fixed expenses

Identify and list all fixed expenses that recur monthly. By acknowledging these commitments early on, you ensure they're always accounted for.

Logging transactions

For each financial transaction, note the date and the amount. This practice is essential for tracking where your money goes and maintaining a detailed financial ledger. It can also help spot trends in spending or earnings, allowing for timely adjustments to your budget.

Summarizing finances

In the summary section, bring together all aspects of your budget to review. This overview should provide a clear indication of where the project stands financially at the end of each month. It should reflect total income, expenses, and the net balance, offering a concise assessment of your financial situation.

Maximizing efficiency: Tips and tricks for budget management

Managing a monthly budget is an ongoing effort that benefits from strategic insights. Here are several tips to keep the budget on track:

Review and adjust regularly: As financial situations evolve, so should the budget. Regular reviews ensure that it remains relevant and effective.

Use visuals: Capitalize on charts and graphs within the template to visualize spending habits and financial trends.

Track actual vs. projected costs: Monitor the variance between anticipated expenses and actual spending to identify areas where adjustments may be needed.

Set financial goals: Incorporate short and long-term financial objectives into the budget to maintain motivation and direction.

Be realistic: Set achievable targets to ensure the budget is a tool for success, not a source of frustration.

With these insights and the template as a foundation, establishing and adhering to a monthly budget becomes an accessible and rewarding practice. It is the stepping stone toward managing projects efficiently and enabling planners to take control of finances with confidence and clarity.

Author: Miro Team

Last update: October 14, 2025