Table of contents

Table of contents

Decision Tree Analysis in Risk Management

Summary

In this guide, you will learn:

Purpose and benefits of decision tree analysis for risk management by visualizing outcomes and probabilities

Step-by-step process for conducting decision tree analysis: identifying decisions, gathering data, defining decision points, assigning probabilities, evaluating outcomes, and calculating expected values

How to analyze and compare decision paths to select the optimal choice based on expected values

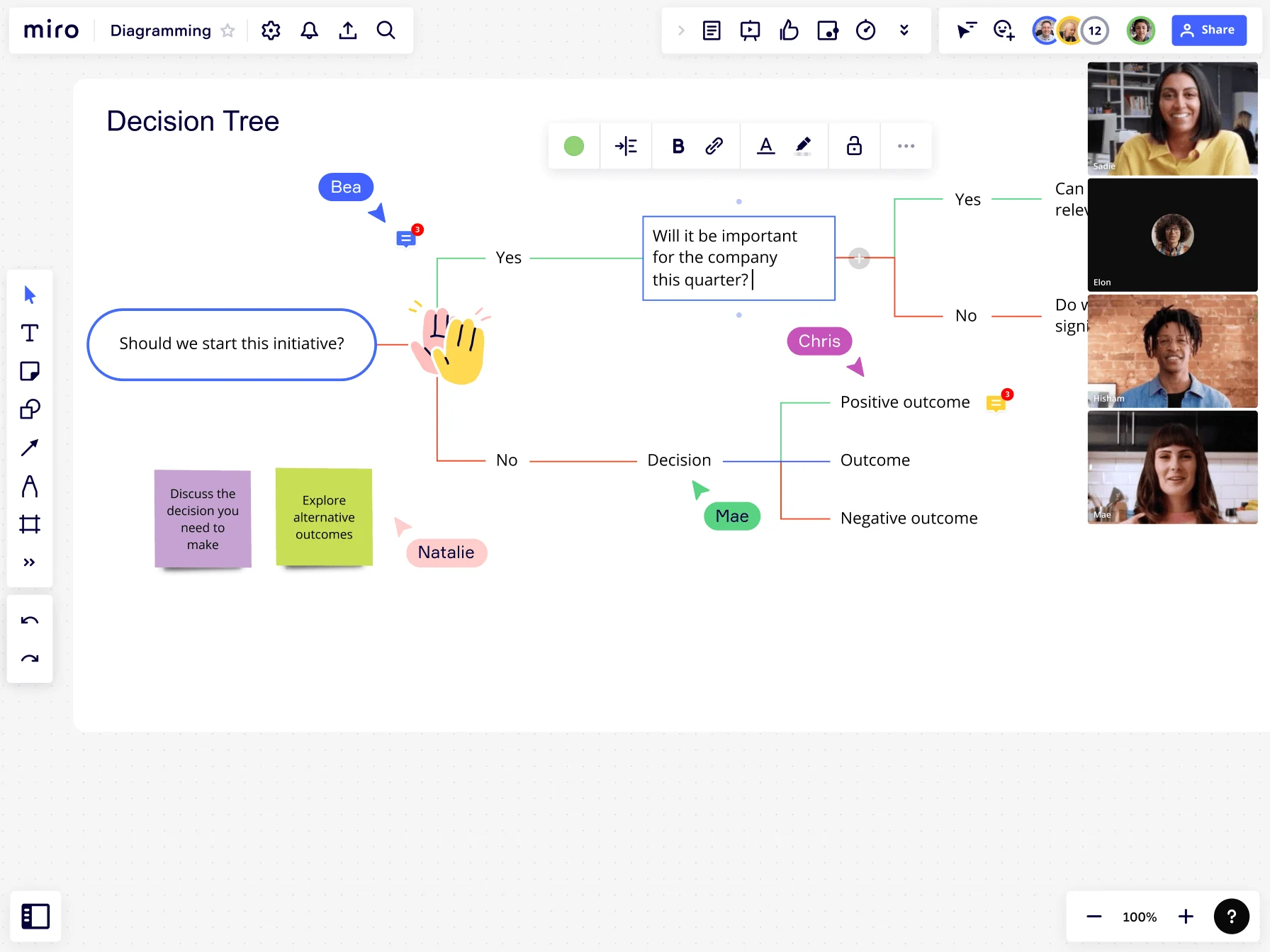

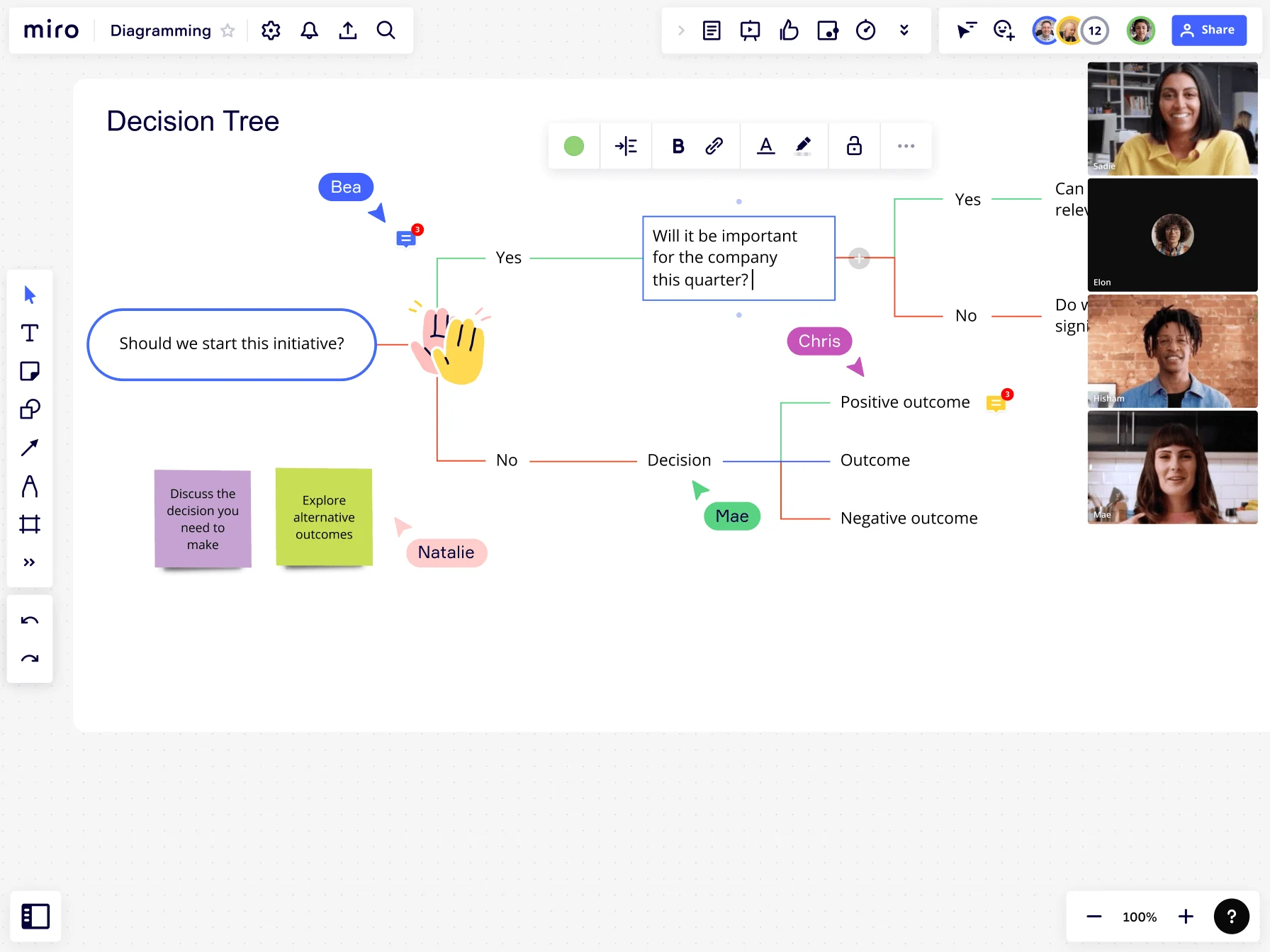

Practical tips for using Miro’s decision tree maker for real-time or asynchronous collaboration

How decision trees reduce bias, solve complex problems, and increase productivity by enabling scenario prediction

Importance of regularly reviewing and updating decision trees for robust risk mitigation

Try Miro now

Join thousands of teams using Miro to do their best work yet.

Understanding Decision Tree Analysis in Risk Management

In the world of risk management, decision tree analysis emerges as a powerful tool for making informed choices. By visualizing potential outcomes and consequences, decision tree analysis assists businesses in navigating complex risk scenarios.

Decision tree analysis, specifically tailored for risk management, enables organizations to assess and address potential risks effectively. At its core, decision tree analysis involves constructing a graphical representation resembling a tree structure. It starts with a question node and branches out into different decision paths, eventually leading to various outcomes.

By quantifying probabilities and weighing potential risks, decision tree analysis empowers decision-makers to visualize the consequences of their choices.

In this comprehensive guide, we will delve into the intricacies of decision tree analysis in risk management, providing expert insights and practical tips for its implementation.

Benefits of Decision Tree Analysis in Risk Management

Implementing decision tree analysis in risk management offers several noteworthy benefits:

1. Informed Decision-Making: Decision tree analysis equips organizations with a structured approach to assess risks, facilitating informed decision-making based on a comprehensive evaluation of potential outcomes.

2. Risk Mitigation: By visualizing various decision paths and their associated probabilities, decision tree analysis enables businesses to identify high-risk areas and develop targeted risk mitigation strategies.

3. Strategic Planning: Decision tree analysis assists in long-term strategic planning by considering multiple scenarios, optimizing resource allocation, and aligning business goals with risk management strategies.

Key Components of Decision Tree Analysis

The key components of decision tree analysis in risk management include:

• Nodes: Decision nodes represent critical points where choices are made, leading to different paths.

• Branches: These pathways emanating from decision nodes illustrate possible actions or choices.

• Outcomes: Terminal nodes depict the potential outcomes resulting from decisions made at decision nodes.

• Probabilities: Probabilities assigned to branches quantify the likelihood of specific outcomes.

• Expected Values: Calculated by multiplying probabilities with associated outcomes, expected values provide a measure of the potential value or risk associated with a particular decision path.

Conducting Decision Tree Analysis in Risk Management

Miro's online canvas and decision tree maker is perfect for creating a decision tree. To perform decision tree analysis in risk management, follow these step-by-step guidelines.

Step 1: Identify the Decision to Analyze

Determine the specific decision or scenario for analysis.

Step 2: Gather Relevant Data:

Collect accurate and reliable data related to the decision and associated factors.

Step 3: Define Decision Points

Identify key decision points and their possible outcomes.

Step 4: Assign Probabilities

Quantify the probabilities of different outcomes based on historical data or expert judgment.

Step 5: Evaluate Outcomes

Assess the potential impact and value of each outcome.

Step 6: Calculate Expected Values

Multiply the probabilities by their associated outcomes to compute the expected values.

Step 7: Analyze and Compare Paths

Analyze different decision paths by comparing their expected values.

Step 8: Make Informed Decisions

Based on the analysis, choose the optimal decision path with the highest expected value.

Practical Applications in Risk Management Scenarios

Decision tree analysis finds practical applications in various risk management scenarios, including:

Project Risk Assessment: Assessing and managing risks associated with project timelines, resource allocation, and stakeholder expectations.

Financial Risk Analysis: Analyzing investment options, evaluating potential returns, and identifying risk factors in financial decision-making.

Supply Chain Risk Management: Identifying vulnerabilities, optimizing supply chain processes, and developing contingency plans to mitigate risks.

Operational Risk Evaluation: Assessing risks related to operational processes, identifying bottlenecks, and implementing risk control measures.

Overcoming Challenges in the Analysis

Despite its effectiveness, decision tree analysis in risk management may present challenges. Here are strategies to overcome them:

Data Quality: Ensure data accuracy and reliability by utilizing robust data collection methods and validating information from multiple sources.

Subjectivity: Address the potential subjectivity in assigning probabilities by seeking expert opinions, conducting thorough research, and relying on historical data.

Complex Scenarios: Simplify complex scenarios by breaking them down into manageable segments and evaluating each component separately.

Best Practices for Implementing Decision Tree Analysis

To maximize the benefits of decision tree analysis in risk management, follow these best practices:

Involve Stakeholders: Engage relevant stakeholders throughout the analysis process to gain diverse perspectives and foster buy-in for the decisions made.

Continuously Evaluate and Update: Regularly review and update decision tree models as new information becomes available or circumstances change.

Consider Multiple Scenarios: Account for various possible scenarios and their associated risks to develop robust risk mitigation strategies.

Decision Tree Analysis vs. Other Risk Management Techniques

While decision tree analysis is a powerful tool, it is essential to compare it with alternative risk management techniques, such as Monte Carlo simulation or SWOT analysis. Understanding the strengths and limitations of each technique allows organizations to choose the most appropriate approach for specific risk management contexts.

Conclusion

In conclusion, decision tree analysis is a valuable method for managing risks effectively. By visualizing potential outcomes and probabilities, organizations can make informed decisions and develop robust risk mitigation strategies. Incorporate decision tree analysis into your risk management practices and leverage its benefits to navigate complex risk scenarios successfully.

Through this comprehensive guide, we have explored the fundamentals of decision tree analysis in risk management. Apply these expert tips and insights to enhance your risk management processes and achieve better outcomes. Remember, informed decisions are the key to mitigating risks and driving business success.

Author: Miro Team

Last update: October 7, 2025